Amherst Has Got Financial Trouble. We Deserve Full Disclosure

Local election season is upon us, and with 10 of the 13 Town Councilors running for reelection on November 4, chances are that many candidates will be describing the state of the town in rosy terms.

But the reality is that Amherst does not have enough money to pay for the services that residents expect, and it can be argued that leaders have not done a stellar job in managing the town’s finances.

See related: Finance Committee Sees ‘Rocky Road Ahead’ for Amherst Budgets

Problems range from the widely decried state of Amherst’s roads, to cuts to school staffing and the public education program, to an under-resourced CRESS community responder department. The inability to fund these needs has prompted the Finance Committee to discuss whether to recommend a Proposition 2 ½ tax override this fiscal year.

An obvious contributor to the town’s money shortage is the controversial decision by the Town Manager and Town Council to commit to a $55 million demolition, renovation and expansion of the Jones Library.

Shouldn’t the council have recognized the bind in which it was putting the town? Yes, they should have, but they have a small excuse. They were given bad advice by people in whom they had placed trust.

Real Fundraising Numbers Needed

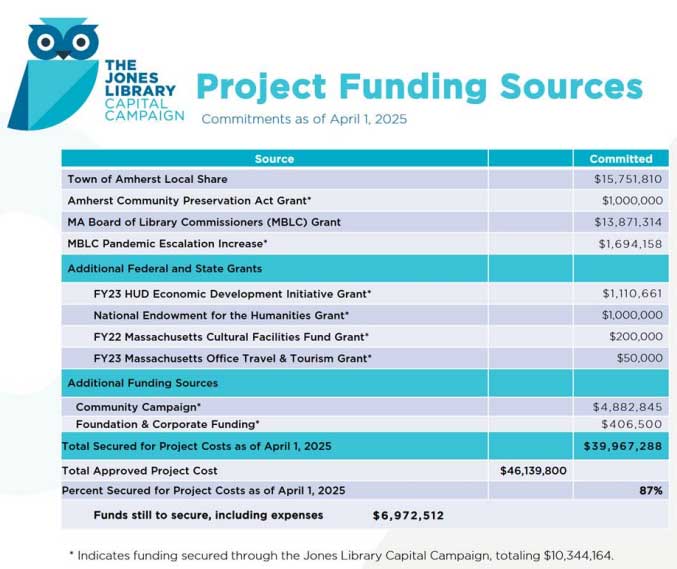

One source of bad advice was the repeated claim by the Jones Library Capital Campaign (JLCC) that it was well on its way to raising the library’s share of projects costs. In April, two weeks before the Council voted 10-3 to allow the construction project to proceed, the JLCC reported that they had raised 87% of their target.

The report neglected to differentiate between donation pledges and actual gifts received, did not identify fundraising expenses that had accumulated to more than $600,000 by April, and included grant funds that had not yet been received in its total. By April 1 the library, which had signed a memorandum of agreement to remit funds to the town as soon as they were received, had only remitted $1,650,000.

It is time for the town to take over the reporting of fundraising progress, and it should simply use the amount transferred to the town treasurer as the measure of success.

In August 2024, former Finance Director Melissa Zawadski calculated the trustee commitment to the library project to be $13,822,518. To date, the trustees have remitted $3,710,661 to the town. Simply stated, the total commitment divided into the amount remitted represents the library’s fundraising progress. This stands at 26.8%, with $10,111,857 remaining to be remitted. With the Jones Library endowment currently valued at $9.1 million, there is no way the trustees can make up the fundraising gap unless very significant sources of revenue are found.

Where’s the Cash Flow?

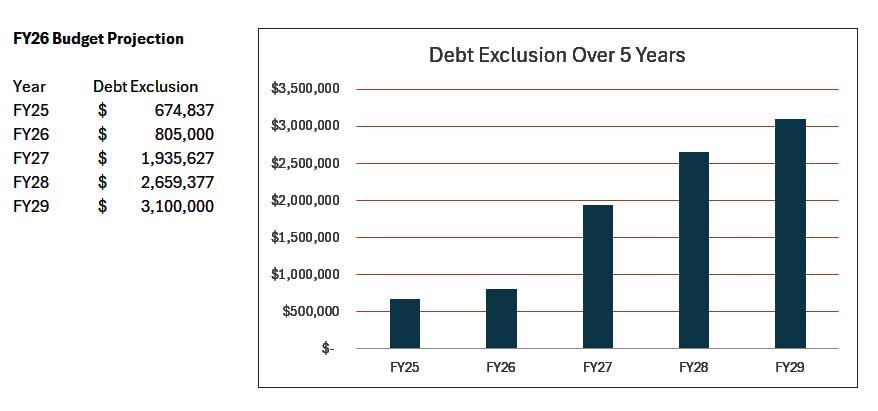

Another vital bit of intelligence that would have helped the town council understand the viability of the library project is a cash flow model. Town Manager Paul Bockelman provided a cash flow memo to the Town Council as input to their decision on December 18, 2023 on whether to authorize the supplemental appropriation of $9.860,100 to cover the unexpected increase in the project cost estimate. It indicated that the library trustees would transfer $6.5 million to the town by January 2025, and that the town would incur $8.7 million in interest payments on top of the “not a penny more” than the town’s $15,751,810 obligation approved back in April 2021.

All 13 councilors were persuaded to approve the supplemental borrowing. Curiously, no minutes of the two meetings in December 2023 where the motion was debated – perhaps the most impactful town council financial decision in its history – are found in the archive of minutes.

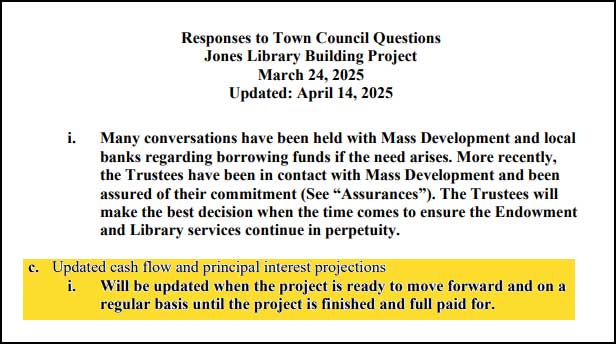

Concerned citizens and councilors pointed out that an updated cash flow was needed when the Town Council met on April 14 to vote on a motion to rescind the $46.1 million borrowing authorization, an action that would have killed the library project.

A Response to Questions in the April 14 Town Council packet assured that the cash flow and principal interest projections “will be updated when the project is ready to move forward and on a regular basis until the project is finished and fully paid for.”

With the demolition phase of the library project nearly complete, there has been no report of any cash flow being prepared by the Town Manager or his Finance Department. This failure to conduct what might be considered basic financial planning before committing to a construction contract and provoking new discussions of a tax override is irresponsible.

The citizens of Amherst deserve better.

See related: Letter: Is Anyone Keeping Tabs on Jones Expansion Project Accounts?

Jeff Lee is a resident of Amherst’s District 5 and a frequent contributor to the Indy.

Sounds like lots of untruthful (lies) things going on here. This is rapidly becoming Amherst’s “Big Dig!”

So what is to be done now? Negate contracts and pay fines? Board up the Jones Library building as it is and continue renting the Slobody Building on University Drive as our library? Considerations…. until people in charge of managing these finances figure out a solution. No more tall tales. No more asking for more tax money. “Not a penny more.”

To the Town Council members, the Town Manager, finance people and Jones Library Committees….. be honest, do your jobs and work for your tax paying citizens. We certainly deserve better than what has been happening.

Who will be held accountable for this mess? For not telling the truth? It is so incredibly unfair to hardworking, taxpaying Amherst residents.

It shouldn’t come as a surprise that this Town has its priorities blinded by the need to support a Jones Library project that should never have been started. We live in a Town that has ample libraries available to everyone because of the Colleges and Universities and the two Amherst owned entities.

Our Full time residents are saddled with unsecured Debt and at the same time we have the poorest roads, an understaffed Fire, Ambulance and Police Departments. A Public Works Department that resides in an old Trolley Repair building. A Senior Center that cannot offer what the Hadley Senior Center provides and the downtown parking is nonexistent.

My family has lived in Amherst since the 1950’s and it has only gotten more out of touch with what the Residents should have for the ever increasing Taxes that are remitted.

We are not Boston or Cambridge; and we should live within our means.

The Colleges and the University should contribute more to our town. They use much of our resources and the should be expected to pay a larger percentage of the expenses.

Amherst pays more than other towns for everything from salaries of people in leadership positions to building construction. Our new school is projected to be $704/sf. The next highest new public elementary school in Mass was $457/sf and the state average was $371/sf in 2024. The council pretends Amherst is a wealthy community but we are not. Our tax rate compared to resident’s income is also the highest in the state.

In my opinion the library was always a vanity project which made zero sense at all time when library attendance has dropped by 50%. We are going to have to cut something because the owners of the 7000 tax paying properties can’t absorb these financial decisions.

Just an unfathomable state of affairs. I’m just guessing here, but since we purchased our house in 1984, the tax base–ie number of new houses–has likely increased approx 20%. Inflation since that time is just over 200% which would result in a tripling of our taxes. Except our taxes have actually quadrupled since that time. Logically, and again, I don’t know the exact numbers, it would seem that the net income to the town from RE taxes has increased somewhere on the order of 30%, adjusted for inflation. Perhaps that is why the town thinks it has money to burn, and burn it the town does quite well. A library that just needed a bit of renovation, useless and dangerous roundabouts with granite razor curbs designed to punch out your tires, and third world roads. Time to build a new DPW building for $30+million I suppose. If I can’t vote for a mayor, I can no longer in good conscience vote in town elections.