Questions Surround Planned Building Project Tax Override

How Much And Which Project(s) Require Additional Property Tax Funding Still To Be Determined

For more than two years Amherst Finance Director Sean Mangano has touted a financial framework for funding four Amherst building projects – construction of a new Central Fire Station, Dept. of Public Works Headquarters, Fort River Elementary School, and renovated 63,000 sq. ft. Jones Library – that includes asking property owners to exceed Proposition 2½ tax limits in picking up the Town’s share of the school building cost.

With only about 35% of the school’s estimated $100 million cost covered by a Massachusetts School Building Authority (MSBA) grant, Library project costs mushrooming to $50 million, inflation rampant and the U.S. economy ailing, Town Councilors and members of the public have begun asking if it is wise to be putting such a large burden on Amherst taxpayers.

Mangano has explained the rationale for attaching an override to the school on the Engage Amherst website as

- Town voters approved temporarily increasing their taxes for the schools once already back in 2016

- To move forward on all four building projects in the near future, the Town will need to exclude debt in the ballpark of the amount projected for the schools. If the school debt is not excluded, then the debt for two of the other projects would need to be

- Repayment on the school debt will not begin for a few years so excluding the debt will allow time for the local and state economy to recover

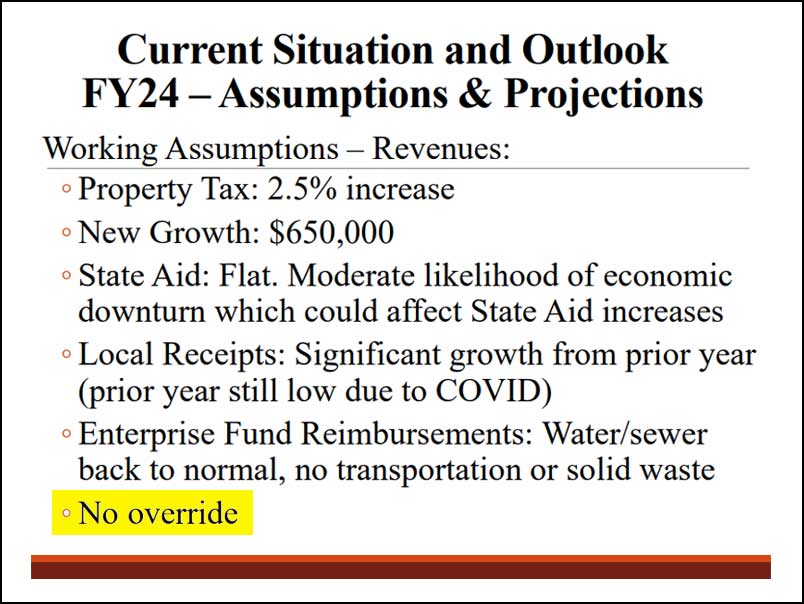

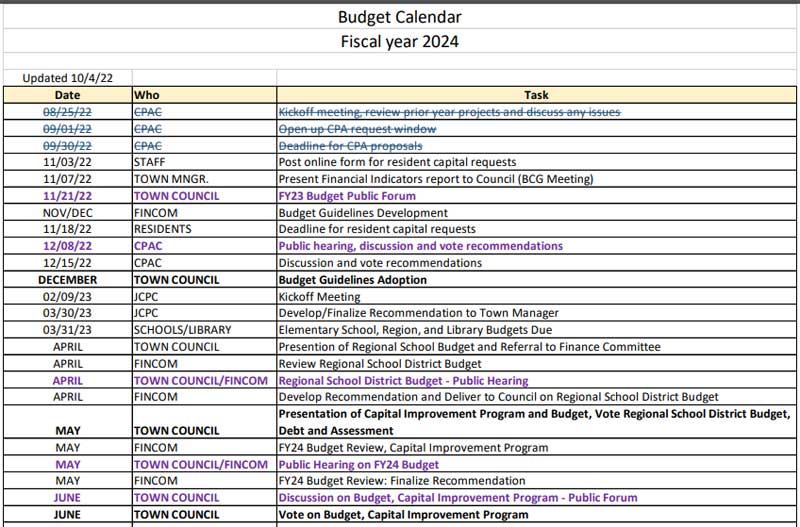

Mangano outlined Fiscal Year 2024 budget planning projections at the November 7 Joint Meeting of the Town Council, Finance Committee, School Committee and Library Trustees. Amherst property owners still reeling from paying their November 1 quarterly tax bills who caught the Financial Indicators presentation may have been puzzled but pleased by assurances of the Town’s strong financial position and a slide proclaiming “No override” in FY24.

This announcement appeared to conflict with a timeline included in the meeting packet that listed the Town Council as crafting language for an Elementary School Project debt exclusion override ballot question in February 2023 and bringing it to a town wide vote in May.

School Committee member Irv Rhodes picked up on the contradiction. “What stunned me, and maybe I’m missing something, is that we’re not predicting an override for ’24,” he said.

Mangano pointed out that there is a technical difference between an override and a debt exclusion. An override allows a community to permanently assess taxes beyond the Proposition 2½ levy limit, while a debt exclusion enables a community to assess taxes in excess of its levy limit for repayments specifically tied to the debt of a capital project. The bottom line, however, is that an exclusion still overrides the Proposition 2½ levy limit and results in an increase in the Town’s property tax rate for the lifetime of the debt being serviced.

Mangano clarified, “We’re not projecting a tax override for ’24 [but] there may be a debt exclusion vote in this coming year.” He added that even if a debt exclusion is approved by the voters next year, the associated tax increase will not begin until after the end of the fiscal year in July 2024.

He attempted to calm concerns by describing a debt exclusion as “temporary.” However, “temporary” means until the debt is paid off, likely to be 20 to 30 years. A debt exclusion passed by Amherst voters in November 1994 to finance $5.6 million for an addition to the High School was not fully paid off until 2019.

The growing price tag for the four capital projects combined with a worsening economy has prompted some Town Councilors to explore ways to lessen the financial harm of a debt exclusion, particularly to Amherst’s less affluent residents and renters who can expect to have tax increases passed onto them.

At an October 18 discussion of capital project funding District 1 Councilor Cathy Schoen called for using capital reserve funds for the school project. “I’m looking to lower the amount we need to raise from taxes,” she stated, and she questioned the assumption that the school be funded solely by debt exclusion. “That is a working assumption that we have made, but I’d like to come back to it,” she said.

At the same meeting Council President Lynn Griesemer asked Mangano, “Is there any way to take a different project like the fire station out for a debt exclusion so that we could reduce what we have to ask the taxpayers for the school?” Presumably the library or DPW projects might also be financed by a debt exclusion for the same reason and would offer voters the opportunity to vote the tax increase down if they felt that the value of the project did not warrant it.

Mangano attempted to discourage that idea, saying that it would be hard to phrase into a ballot question that the voters could understand, however his argument was difficult to follow.

“We could do that exclusion for the fire station as a separate decision. The thing to remember with debt exclusions is that the town is giving permission to incur debt so you can’t say necessarily, you can provide information, but unless you’re gonna um let’s say the fire station, if you wanted to do the debt exclusion for the full cost of it, again that would just go out to them for a vote. But say you only want to do half the way you fund that other half, you may or may not be able to communicate that to taxpayers with assurance. So if you’re going to take the other half and still borrow for it coming from the tax levy, the town is still going to have to vote on the full amount. But if you were to take the other half and pay for it from reserves instead, then you would reduce the debt authorization so you could more positively say in that circumstance the debt authorization for the fire station is only 10 million as opposed to 20 million.”

“Sorry, that got kind of wonky,” he apologized.

Given that Amherst residents are probably anxious to find any possible way to reduce their already high property taxes, Griesemer’s suggestion that one or more other building projects assume the debt exclusion burden in addition to, or in lieu of, the high priority and grant-funded elementary school project, seems worth pursuing.

As District 3 Town Councilor Dorothy Pam said at a September 12 Council review of skyrocketing library cost projections, “The [Jones Library] Building Committee has an Owner’s Project Manager (OPM) and I’m beginning to ask ‘who is the OPM for the taxpayers of Amherst?’”

Town Council To Host Public Budget Forum On November 21

A public forum on the Fiscal Year 2024 town budget will be held on Monday, November 21. The forum will offer information on the construction of the FY24 budget and offer the public an opportunity to provide input on priorities. At the time of this writing, the meeting has not been posted. Watch the online town calendar for details.

While this post questions the use of the word “temporary” to describe debt exclusions that may affect the tax levy for 30 years, in fairness to the Finance Director, there is a second reason that exclusions are sometimes labeled “temporary”. That is because, unlike regular overrides, debt exclusions do not permanently raise the base value upon which the 2.5% levy limit is calculated.

This is a fine point and one of many of Proposition 2 1/2’s complexities. Residents are encouraged to bone up on how debt exclusion overrides serve as a municipal funding tool along with other revenue sources for capital projects. Exclusions can have a considerable impact on property owners’ annual tax obligations, and indirectly on rents.