FinCom Hears Plans To Bump Up Sewer Rates, Add Local Real Estate Transfer Tax

Photo: istock

Amherst Finance News Highlights For The Week Of December 5, 2022

New Sewer Regulations Will Drive Rate Hike Described As ‘Very Significant’

In previous public meetings the Department of Public Works (DPW) has proposed updates to the town’s sewer use regulations aimed at ensuring that new lines are constructed properly, prohibiting harmful materials from being put down the drain, and laying out a new ownership model for sewer lines shared by property owners and the town. The Finance Committee learned at its December 7 meeting that the new ownership model comes with increased costs to the town that must be borne by ratepayers.

[See related New Sewer Bylaw Will Determine Who Pays For Water Line Repairs]

Town Finance Director Sean Mangano introduced a DPW presentation saying that infrastructure projects are forcing rates up, resulting in “at least for one year a very significant increase that for some people may be difficult to absorb.”

DPW Assistant Superintendent Amy Rusiecki explained that the town proposes taking ownership responsibility for all portions of the sewer line up to the boundary of the property that it services. This contrasts with the previous model in which the town only owned the main sewer line and the property owner was responsible for any sewer line repairs beneath roadways and rights-of-way or through easements on neighbors’ land. This scenario has sometimes resulted in unanticipated repair costs to property owners that have amounted to thousands or even tens of thousands of dollars.

To take responsibility for infrastructure between the sewer main and private property lines, the town must add a cleanout at every point where the sewer line meets the property line. This change, plus repair responsibilities on the newly acquired lines, is estimated to ultimately add $730,000 to $1,460,000 to the annual sewer budget.

The DPW proposes softening the blow to ratepayers by adding only $500,000 to the FY24 sewer budget line item. Recouping this cost will require bumping up the annual Amherst sewer usage fee by $0.55 per hundred cubic feet (HCF) from its current rate of $5.20 per HCF. This represents an increase of $50.60 per year for the average Amherst user who generates 9200 cubic feet of sewage annually.

Combined with a water rate increase helping to support a new Centennial Water Treatment plant, Mangano estimates that the average FY24 total water/sewer bill will go up by about $100.

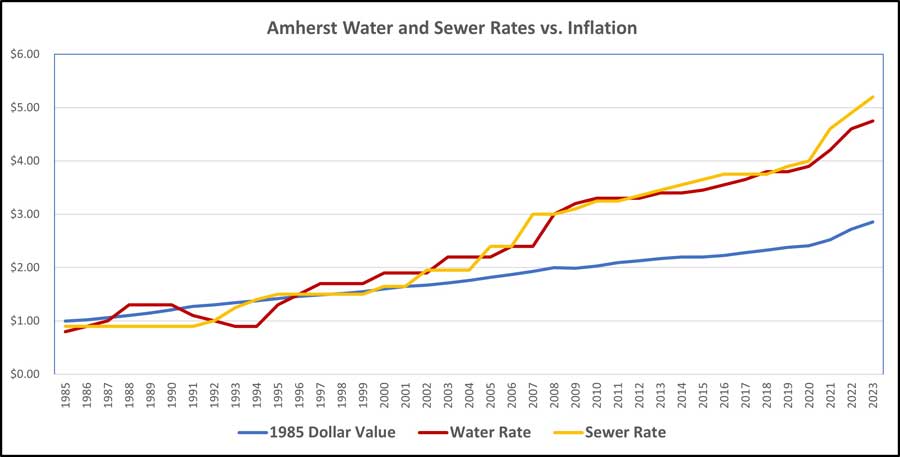

Even before the FY24 water and sewer rate hikes, Amherst residents have seen a steep rise in usage rates. FY23 rates were roughly 5 times higher than 1985 rates, a rise that is nearly twice the 2.77% inflation rate over the same period.

Town Manager Paul Bockelman has pointed out that despite the steady historic increase, Amherst water and sewer rates compare favorably to several other nearby towns.

Councilors Seek Special Legislation Allowing Town To Levy 2% Property Transfer Tax

Town Councilors Ana Devlin Gauthier (District 5) and Mandi Jo Hanneke (At Large) have formulated a plan to enable Amherst to levy a 2% transfer tax on the sale of real estate. Their initiative involves a two-step process.

First, local state legislators will introduce legislation that will allow Amherst to levy a local real estate transfer tax of up to 2% of a property’s sale price. State Representative Mindy Domb has been offering advice.

Should this legislation pass, Devlin Gauthier said that the Amherst Town Council will be asked to pass a bylaw that would limit a new 2% transfer tax to sales of non-owner-occupied properties, and high-end properties that exceed 200% of the average Amherst property value. “No one is planning to do a two percent fee on all Property Transfers,” Devlin Gauthier said.

Devlin Gauthier’s and Hanneke’s goal is to discourage the recent problem of investors buying up single family homes and converting them to often lucrative student rentals, causing a scarcity in family housing. In addition, the tax would generate revenue that the sponsors would like to see directed toward the Amherst Municipal Affordable Housing Trust (AMAFT), the town’s operating budget and capital stabilization fund.

Hampshire County home sellers currently pay a 0.456% tax on their property’s sale price. Devlin Gauthier described the proposed property transfer fee as being paid by both buyer and seller.

In 2021, analysis shows that Amherst would have raised $1.4 million through the tax proposed by Devlin Gauthier and Hanneke, with most coming from non-owner-occupied properties. Other Massachusetts communities that are seeking to enable a local property transfer tax collection include Boston, Cambridge, Brookline, Somerville and Concord.

Town representative to the Finance Committee Bernie Kubiak commended the proposal as “a really good idea and some creative work, one of the few I’ve seen in my gazillion years here in town.”

Town representative to the Finance Committee Bob Hegner on the other hand stated, “I have some serious concerns about this whole idea.” He pointed out that properties subject to the transfer tax are already paying a CPA surcharge for a similar purpose (affordable housing) and he questioned the justification for double taxation. He also cautioned that rental property buyers being hit with a 2% transfer fee could simply pass the cost onto their renters and therefore face no real disincentive to converting an owner-occupied property to a rental.

Devlin Gauthier and Hanneke reported that the details of the bylaw spelling out which property transfers would be taxed have not been fleshed out since it depends on the passage of state legislation – an outcome that can be both time-consuming and uncertain.

Deadline For Submitting A Resident Capital Request Is End Of December

The Town of Amherst is now accepting resident capital requests for one-time expenditures out of the town’s capital budget. Requests must be submitted by December 31, 2022.

See https://www.amherstma.gov/3690/Resident-Capital-Request for more information.