Ever Upward — A Modern History of Amherst Tax Bills

Average Amherst Property Tax Bill Has Risen By 585% Since 1988

The Massachusetts Division of Local Services (DLS), the state agency responsible for ensuring fairness and equity in local property taxation, maintains a wealth of financial, demographic and economic data on cities and towns. In particular, the DLS tracks the average value of a single family home in each community, and the local property taxes levied on these homes, with data going back to 1988.

Amherst residents are likely acutely aware of the weight of the town’s property tax. It directly affects affordability for both home and business property owners, and impacts renters who see their landlords’ taxes reflected in their rents.

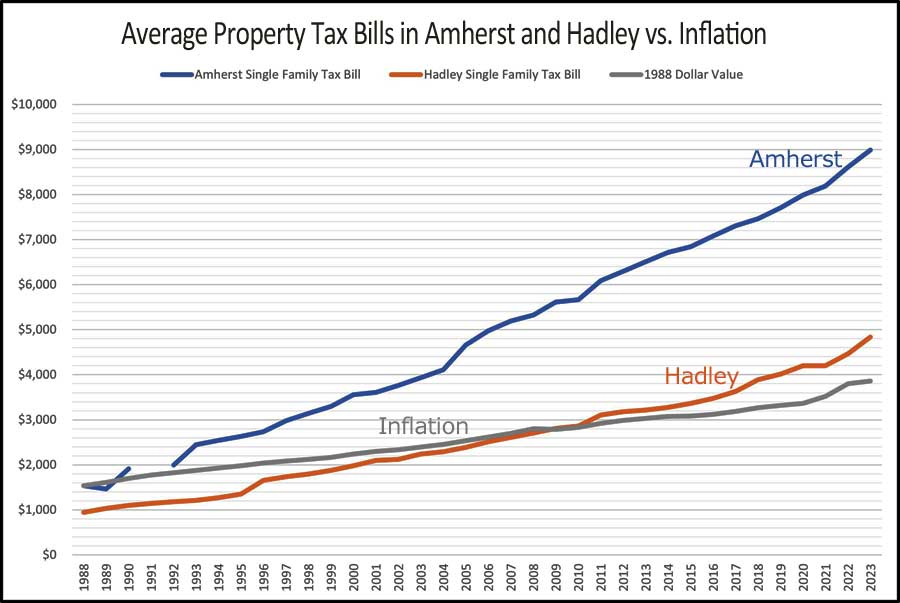

A review of the average Amherst tax bill over the past 35 years shows a steep rise, outpacing the increase found in other Western Mass. towns as well as the state as a whole. The graph above exhibits the trend.

In fiscal year 1988 the average Amherst single family home was valued at $128,095 and this average home was assessed $1537 in property tax, based on a tax rate of $12.00 per $1000 of property value. By 2023 the value of Amherst’s average single family home had grown to $446,953 and the average tax bill had climbed to $8984 – an increase of 585%. This bill is based on a FY23 tax rate of $20.10 per $1000 which ranks as the fifth highest rate in the state.

By contrast, residents of Amherst’s neighbor to the west, Hadley, paid an average property tax of $942 in 1988, assessed on the average single family home worth $93,696. In 2023 the average Hadley tax bill is $4833, the result of a tax rate of $11.54 per $1000 applied to the average single family home value of $418,761.

Today the average Amherst homeowner pays $4151 more in annual property tax than the average Hadley homeowner, a difference of 86%. Despite this differential, Hadley has managed to cut the ribbon on a new $8 million library and $5 million senior center in the past three years, its public schools are on a par with Amherst’s according to niche.com, and it is home to an impressive array of farms and open spaces. Hadley, like Amherst, hosts a portion of the University of Massachusetts campus.

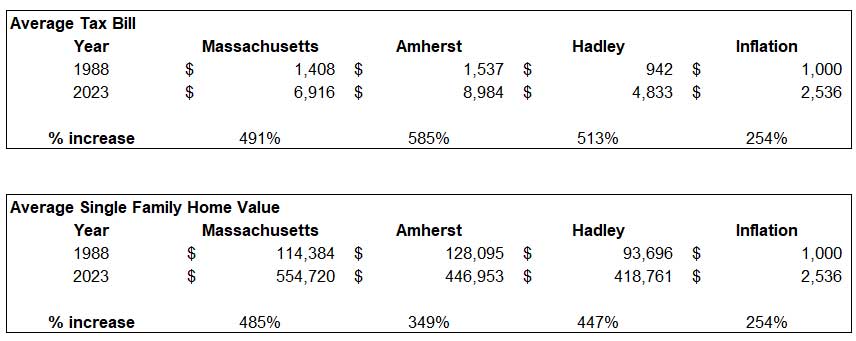

The 35-year change in home valuations and property tax bills is illustrated in the table below.

In addition to Amherst and Hadley statistics, the table includes averages across all 351 Massachusetts cities and towns, and the change in the value of $1000 caused by inflation.

It can be seen that the appreciation of single family homes in Amherst has not matched the rate of appreciation in either Hadley or the state as a whole. On average, Amherst home values have risen 349% since 1988, while the average home values in Hadley and across Massachusetts have risen by 447% and 485% respectively.

The fact that Amherst tax bills have risen by 585% while the town’s average home valuations have risen by only 349% indicates that there is another factor at play beyond rising home values to explain the climb. That would be the Proposition 2 ½ tax overrides and debt exclusions that Amherst voters have approved over the years.

The DLS reports that Amherst has passed Proposition 2 ½ tax overrides on 3 occasions: in 1991 for $1.7 million, in 2005 for $2 million, and in 2011 for $1.7 million. A debt exclusion override was passed in 1994 to service Amherst’s roughly $5.8 million share of debt for a Regional High School renovation and expansion. Estimates at the time projected that the debt exclusion would increase property taxes for 20 years, peaking at an additional $150 – $175 per year on average for the third and fourth years.

The average Amherst tax bill has jumped by more than $360 in a year on six occasions: $447 in FY 1990, $452 in 1993, $553 in 2005, $422 in 2011; $414 in 2022 and $376 in 2023.

The Amherst Town Council is promoting two multi-million-dollar capital projects for which funding will need to be lined up in the coming year — a renovation-expansion of the Jones Library currently budgeted at $46.1 million with a town share of $15.8 million plus financing costs estimated at $9 million, and a $100 million replacement of the Fort River Elementary School with the town’s share being roughly $65 million plus financing costs. The Town Council has authorized the library project to be funded with tax dollars already collected and is expected to seek voter approval for residents to finance the Elementary School project with a debt exclusion property tax increase this May.

Very informative – thank you for doing the research. Your findings are consistent with our property tax increase since we bought our property and house in 1994.

I am a past president of the Jones Library Board of Trustees. From grades 1 – 12, I attended public schools. Our three children did the same. Replacing the public Fort River and Wildwood elementary schools is more important than expanding the ample Jones Library. Given Amherst’s property taxes, a new school should be funded “with tax dollars already collected.” It is a property tax increase for the needless Jones Library expansion on which Town Council should allow Amherst voters to vote.

Does the Council majority’s insistence on an override to pay for the new school, while paying for the Jones Library’s demolition/expansion from current tax revenues, reflect its realization of how little the latter project is supported?

Comparatively, overrides to bond school projects in Amherst have fared well, but the Council majority’s position makes one wonder if the school override will succeed this time — and if not, will the Council majority be held accountable?

If the school override fails, Town Meeting will be dug up from its grave and again be held up to blame for not supporting the first failed override for the consolidated elementary school project. If and when that happens, and perhaps even before, the following numbers should be considered. In November of 2016 — a presidential election year — 68% of Amherst voters turned out to also vote on Question 5, the school override. Of that number, 45% voted yes, 44% voted no, and 10% left the question blank. Such numbers can be interpreted as representing a town that was equally divided on the question, with no clear majority prevailing. In January of 2017, a Special Town Meeting was held to approve a bond authorization so that the school project could move forward. To say that tensions were high would be an understatement. That night, with 88% of Town Meeting and ex officio members present, the vote was 123 yes votes, 92 no votes, and 9 absentions (57% in favor, 43% opposed). A 2/3 majority was needed to approve the bond authorization, and it was not met. After this vote, signatures were successfully collected to force a townwide referendum on Town Meeting’s vote, which was held in March of 2017. Again, a 2/3 majority was needed to overturn the question. This time, in contrast to the 2016 election, only 30% of Amherst voters turned out. Of that 30% — less than half the number that voted on the project in 2016 — the votes mirrored almost exactly those of Town Meeting: 57% voted in favor of overturning Town Meeting’s vote, and 43% voted to uphold it. If we can conclude any more than the fairly evident fact that Amherst is a very divided town, we can argue that it was actually Town Meeting that was more in favor of the failed school project than were the voters themselves. But it is much easier to blame a convenient target than it is to accept that many, or even a majority of, residents — and taxpayers — have their reasons to not support a project.