Opinion: Four Ways To Assure Amherst Builds A New School, Without Pricing Residents Out

Architect's rendering of proposed new elementary school at Fort River. Photo: amherstma.gov

As many have written in The Amherst Indy, the $98 million Elementary School Replacement project would bring major benefits to the town. It solves an array of problems with the aging Wildwood and Fort River Schools; as a net-zero building it will be a model of sustainability for the entire state; and by consolidating two schools into one it will save money.

But the means of funding it proposed by the Town Council – paying for the town’s $53 million share of the cost with a Proposition 2 ½ debt exclusion – will undeniably bring severe financial stress to many Amherst residents. The resulting tax hike will cost the average homeowner $496 per year for the next 30 years on top of regular tax increases that have averaged $304 annually over the past five years.

The Town Council should think outside the box and make some hard choices if they truly want the school project to succeed while keeping Amherst affordable for all income levels. I offer these suggestions.

1. Dig Deep Into Reserves

Town Councilor Ellisha Walker’s impassioned description to the Finance Committee of how tax-driven rent increases devastate Section 8 Voucher recipients is must-viewing for anyone wanting to understand the true impacts of the proposed debt exclusion.

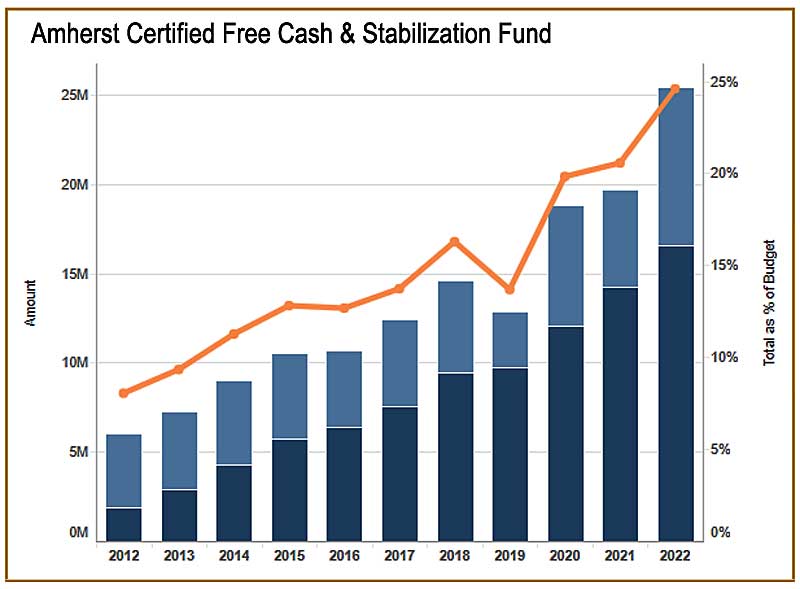

The Massachusetts Department of Revenue has reported that Amherst has more than $25 million in free cash and stabilization “reserves,” including $9.5 in a recently seeded Capital Stabilization fund set aside to pay for capital projects such as the new school. Town Councilors will argue that drawing more than $5 million from capital stabilization to reduce borrowing for the school will put the three other projects in the “One Town, One Plan” at risk of being underfunded. But what is more important, paying for a new and as yet undesigned fire station without debt and completing a $50 million Jones library renovation-expansion, or keeping Amherst affordable for low and middle income residents? We should use $10-$15 million of available cash reserves to reduce the average tax hike by $90 – $135 per year.

2. Kill the Library Project, and Soon

The Jones Library Renovation-Expansion project was over-ambitious from the start and has grown only more untenable over time. Since September 2022 when the Jones Library Building Committee (JLBC) received updated cost estimates showing the project to be $14 million over budget, Amherst has continued to pour money into design and project management services. Finegold Alexander Architects regularly bills the town $136,250 per month for design development, and it is estimated that carrying the project to next February when construction bids will be received and when Amherst can reassess whether fundraising has plugged the budget gap will cost $1.8 million. How many road repairs or educator COLAs might this money fund?

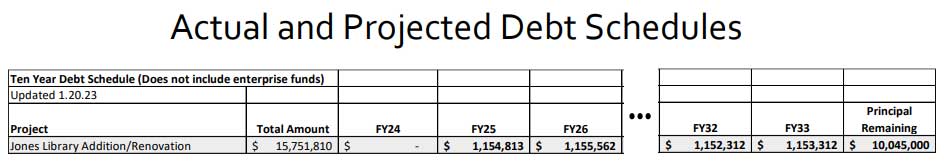

The town’s FY24 Capital Improvement Program shows Amherst committing about $1.15 million per year for twenty years to service library project debt, and it is based on optimistic pre-inflation numbers.

We should stop the bleeding and redirect the library debt service toward urgent library repairs and lowering the override needed for the school. The Town Council needs to do this before the May 2 debt exclusion vote to maximize its chance of passing.

3. Move the School Debt Exclusion to Other Projects

Finance Director Sean Mangano has estimated that the cost of the elementary school project is roughly equal to the combined cost of the other three proposed building projects. Why not use debt exclusions to fund the DPW, fire station and library projects, and pay for the high priority school project from the town’s capital budget?

Town councilors have characterized multiple debt exclusions as something to be avoided, but that is really not the case. Hadley voters have passed 391 debt exclusions since 2002, and the average Hadley homeowner still pays $4151 per year less in property taxes than the average Amherst homeowner. A benefit of debt exclusions is that they require approval in a town wide referendum and so leave the funding decision up to the voters rather than the 13-member town council. That is true democracy, and this model will ensure that the school gets built.

4. Have a Backup Plan

Town councilors have predicted a doomsday scenario of expensive repairs to dilapidated schools if the school debt exclusion ballot question does not pass, but that is only because they have not prepared (at least publicly) a backup plan. Should the May 2 debt exclusion vote fail, which it well might given the burden it puts on taxpayers, the town council would be foolish not to have a contingency plan at the ready to keep the high priority grant-funded elementary school project moving forward.

Indications are that the majority of councilors do not favor the three suggestions described above. However, if their backs are against the wall, and if they hear enough citizen complaints, they just might take one or more of these taxpayer-friendly and school-project-protecting steps, and, if necessary, put the school debt exclusion to a second vote.

Well put, Jeff! I really hope the school override passes with a very comfortable margin (it’s truly a great project!) but I also hope the Town’s leaders do have a Plan B ready to go if the override were to fail. We need this school project to go ahead for many reasons.

As for the library, it has had many years to get its expansion project underway and it’s still far out of reach. It’s time to accept defeat and let that dream go.

“Architects regularly bills the town $136,250 per month for design development”?!

That’s more than 20 teachers’ salaries!

Who’s minding the shop?

I really appreciated your thoughtful approach to this. When described this way, it really demonstrates how the library project is a financial sinkhole- and I was horrified to see what the architect is charging per month! That’s enough money to pay all the paraeducators and keep the teaching staff that are about to be cut!

Not only is “$136,250 per month for design development” a huge amount of money. The design itself cannot be used as is.

This is because the Town and Library Trustees have never submitted their demolition designs to the Massachusetts Historical Commission for its historical preservation review. Nonetheless, State law and their grant contract required them to do this long ago.

The Town and Trustees are accordingly in breach of their $13,700,000 construction grant contract with the Massachusetts Board of Library Commissioners [MBLC]. If the MBLC refuses any more grant money for this demolition/construction project, it will only be doing what State law provides. The same is true if the MBLC makes the Town disgorge the $2,700,000 grant installment (with interest) that it has already received.

Finegold Alexander Architects knows all this perfectly well. Colliers International, the Town’s Owner’s Project Manager, knows this also. The Town Manager and Town financial staff know it. The Town Council and Library Trustees are well aware of it.

Their legal obligation is clear. Their default’s financial implications for the Town are severe. Is there any evidence that our Amherst public officials take this seriously? None that I have ever seen.

Sarah, That makes eye-popping reading. Thank you for laying that out.

I don’t need to ask “Why is this information not all over the place in the public’s face?” For instance in a local newspaper: it’s sort of newsworthy, one would think.

Or is it? Maybe this is pretty routine for how things work?

I’m just trying to understand what could be making it possible for our Amherst public officials *not* to take these really egregious financial failures of responsibility seriously.

Is it that if the grant funds are mismanaged, the only consequence is that no more will be provided? So you’re go to go until the spigot gets shut off?

No process to recover mismanaged funds ( and/or consequent loss to the tax-paying public) from those to whom the funds have been misdirected?

Who carries the liability? Is it the Town’s *public*, not the public *officials*, nor any associated beneficiaries?

There’s no State “Public Official Overseer”? No Big Grant Managers to manage the grant managers?

If that’s how this all works I can understand why you’ve not found any evidence of any public official or associated beneficiaries taking this seriously.

I would also understand why they wouldn’t be inclined to, unless and until some pieces of that game get changed. It would be the small town version of the all the other big money games – Wall street Fantasy Finance Football; Too Big To Pop Bubble Banks… that sort of thing – the ones where the winners are assured of always walking away winners, even if they do have to first learn how to step carefully over some bumps in the road along the way.

Please someone… I must be missing something, probably a lot of things.

Or maybe “Bigtime Bull**** a la Bell”?

Of course, this

https://en.wikipedia.org/wiki/City_of_Bell_scandal

could never happen here in Amherst….