By This Measure Amherst Has the Least Affordable Property Taxes in the State

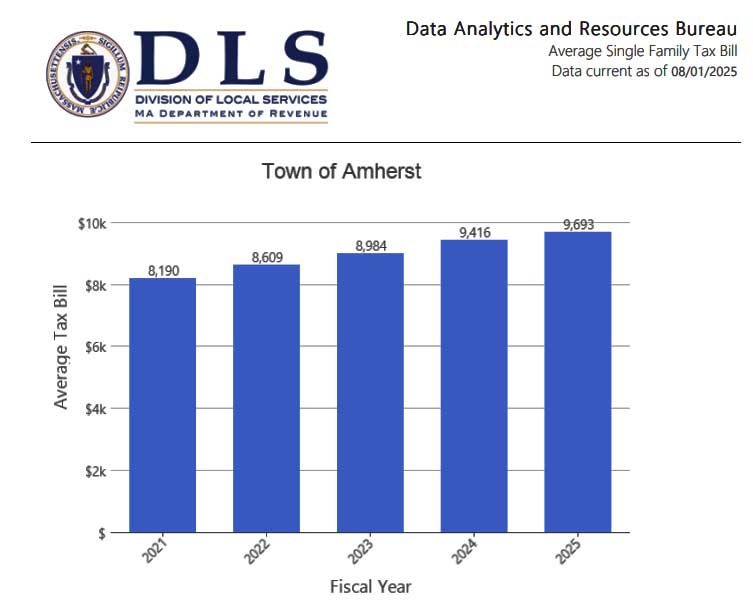

Annual property tax on the average Amherst single-family home over the past five years. Source: MA Division of Local Services

As most Amherst homeowners are painfully aware, August 1 marks the due date for the first quarterly property tax payment of the new fiscal year.

Town Council President Lynn Griesemer touched the subject of property taxes as a guest on WHMP’s Talk the Talk show on July 9.

Speaking about Amherst’s $45 million backlog of road repairs, Griesemer remarked, “Sometimes people suggest that we should do an override for roads. Well, I don’t think the people in Amherst are particularly anxious for any more overrides. Their tax bills just included the new elementary school. I don’t know about other people, but I looked at ours and I went ‘Whoa!'”

Griesemer was referring to Amherst’s first quarterly property tax bill for FY26 which, when totaled for the year, comes to $9693 for the average single-family home. The tax mil rate of $17.95 per $1000 of property value represents the 14th highest rate in Massachusetts for the year. The town’s tax levy limit for FY25 exceeds the 2.5% increase imposed by Proposition 2 ½ by $691,807. This is the amount needed to service the debt for the Fort River School project that is subject to a debt exclusion passed by the town in 2023.

The town website explains that the first two quarterly bills of the fiscal year (due on 8/1 and 11/1) are “preliminary bills” based on assessment information from the previous year. The third and fourth quarter bills are “actual bills” reflecting the tax rate approved by the state Department of Revenue in December.

One bill examined by the Amherst Indy shows the quarterly assessment rising by 6.4% between May and August of 2025. Property owners can inspect the history of their own tax bills by locating their records on the town online bill pay service.

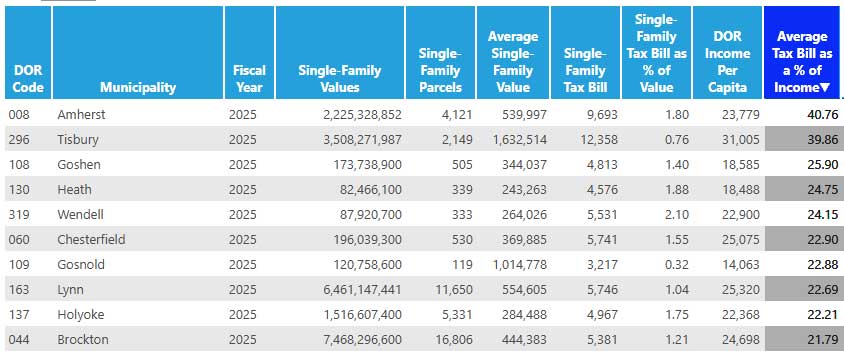

Amherst Leads Massachusetts in Average Tax Bill as a % of Income

The Massachusetts Division of Local Services maintains a databank containing a wide variety of tax-related data for municipalities. Among the statistics tracked is a metric called “Average tax bill as a % of income.” As the name suggests, it is computed by dividing a community’s average single-family tax bill by the per capita annual income of residents. The resulting number can be viewed as an index of how difficult it is for residents to afford their property tax liability, or the related impact on their rent.

With an income per capita of $23,779 in FY25, Amherst’s average tax bill as a % of income was 40.76%. This value is the highest among the 352 cities and towns in Massachusetts.

Property owners who may have missed the August 1 due date for their tax payment are advised to get it in quickly. Massachusetts law sets a penalty of 14% per annum for late payments, with no grace period.

Speaking about Amherst’s $45 million backlog of road repairs, Griesemer remarked, “Sometimes people suggest that we should do an override for roads. Well, I don’t think the people in Amherst are particularly anxious for any more overrides. Their tax bills just included the new elementary school. I don’t know about other people, but I looked at ours and I went ‘Whoa!’”

Interesting coming from someone committed to getting the unnecessarily oversized and overpriced Jones Library project through before needing an override for the school, while ignoring the 25+ year needs study for a new DPW and Fire Station.

I agree that priorities are off. The budget for any kind of maintenance is way too low. I recommend that the town sell the south common school property, wildwood school property and use those funds to help pay for a DPW facility and a fire station. Then sell the fire station. If they can’t sell it, lease the road-adjacent land at Hickory Ridge for more housing. Use the income to maintain roads and roofs. The town council has shown they are not capable of reasonable property management. Letting a roof leak for 14 years, schools get moldy, a bridge rust for 20 years, is not good management. Any property they don’t have to own they should sell.

So what to do?

When the pot holes proliferate, our cars need more and more expensive repairs. And more dangerous accidents. .failing to maintain the roads shifts costs from the town to drivers. Is this the fiscal prudence Griesemer advocates?