Opinion: A Better World Is Possible. A YES Vote On Question 1 Will Improve The Lives Of Massachusetts Residents

Photo: Fair Share Massachusetts

Source: fairsharema.com

Next month, Massachusetts residents will have the opportunity to enact an amendment to the state constitution that would substantially improve the state’s education and transportation systems. Those improvements would be funded by requiring the very wealthy to pay their fair share of taxes.

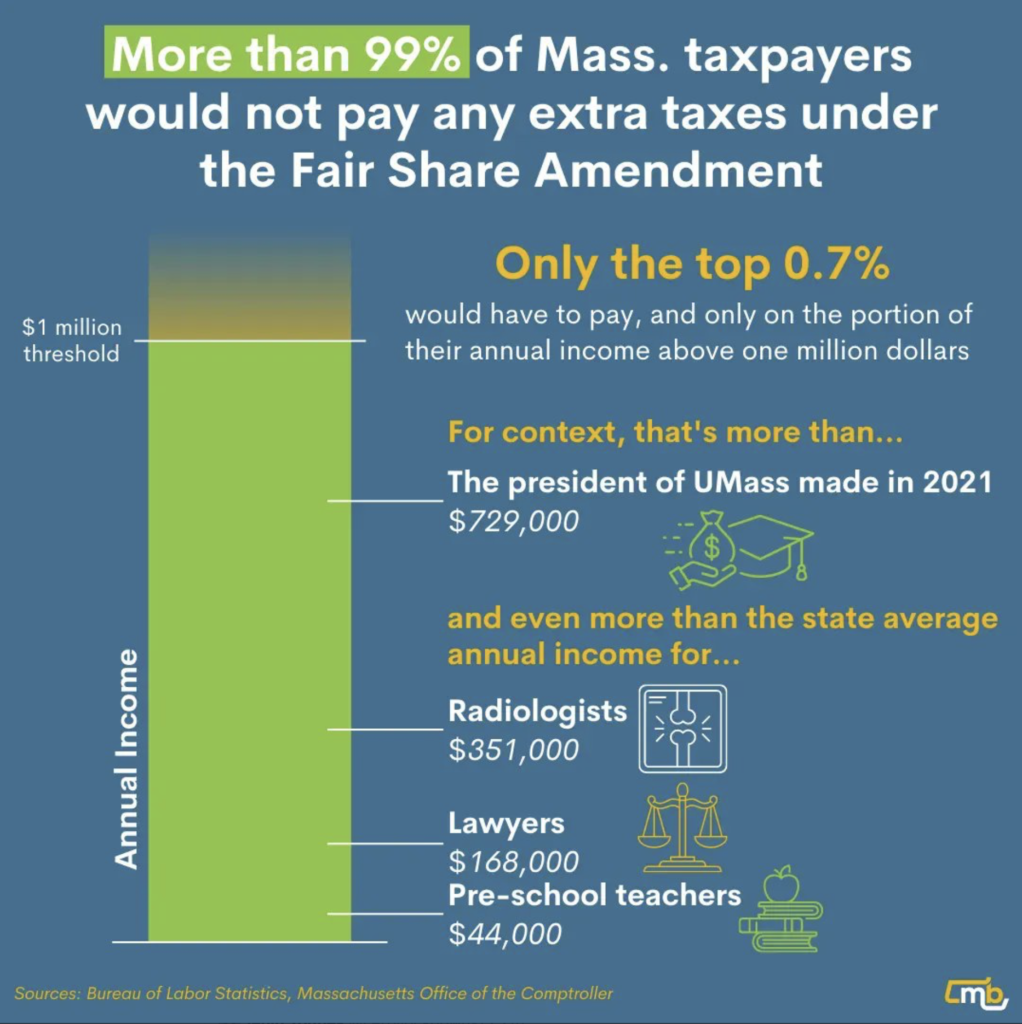

Question 1 would create a 4% tax on the portion of a person’s annual income above $1 million and require — in the state constitution — that the funds be spent only on transportation and public education. Only people who earn more than $1 million annually will pay more; 99% of us won’t pay a penny more. And we’ll all benefit from better schools, colleges, roads, bridges, and public transportation.

That’s why so many people across Massachusetts are coming together to vote YES on 1: because with Question 1, we all win.

As we recover from COVID, we need to make sure our public schools have everything they need for students to thrive. We need to end the educator and counselor shortages so that every student has the support they need. We need to help students get back on track from COVID disruptions and ensure that all students have access to a complete, well-rounded education. We need to repair our state’s backlog of hundreds of neglected and structurally dangerous bridges, roads, and trains. We need to make our public colleges affordable again so students can graduate without taking on enormous debt. And we need to increase access to vocational education as we rebuild our economy for working families.

If we don’t address these problems now, they’ll only hold back our economy and hurt working families. It’s time for the very rich to pay their fair share so we can recover from the pandemic and rebuild a Massachusetts economy that’s stronger than ever.

The bottom line: the Fair Share Amendment would only raise taxes on the top 1% of Massachusetts residents—those who earn more than a million dollars in a single year. It will make our tax system fairer while generating $2 billion a year, every year, that is constitutionally dedicated to transportation and public education.

What Does The Amendment Say?

Article 44 of the Massachusetts Constitution is hereby amended by adding the following paragraph at the end thereof:

To provide the resources for quality public education and affordable public colleges and universities, and for the repair and maintenance of roads, bridges and public transportation, all revenues received in accordance with this paragraph shall be expended, subject to appropriation, only for these purposes.

In addition to the taxes on income otherwise authorized under this Article, there shall be an additional tax of 4 percent on that portion of annual taxable income in excess of $1,000,000 (one million dollars) reported on any return related to those taxes.

To ensure that this additional tax continues to apply only to the commonwealth’s highest income taxpayers, this $1,000,000 (one million dollars) income level shall be adjusted annually to reflect any increases in the cost of living by the same method used for federal income tax brackets. This paragraph shall apply to all tax years beginning on or after January 1, 2023.

What This Means

The Fair Share Amendment is a call for the richest Massachusetts residents to step up and pay their fair share in taxes. Our Commonwealth’s economy is working great for those at the very top — now it’s time for it to work for everyone. The Fair Share Amendment will require those making more than $1 million in a single year to pay their fair share in taxes — just 4¢ more on each dollar after their first million dollars a year. No one who makes under $1 million a year will pay a cent more.

When millionaires and billionaires pay just 4¢ more on each dollar after $1 million, Massachusetts will raise $2 billion a year, every year, to invest in education and transportation. That $2 billion is constitutionally required to go only to education and transportation: our public schools from pre-K to college, roads, bridges, trains, and buses around the Commonwealth.

What Will The Fair Share Amendment Do For Massachusetts Residents?

With an additional $2 billion each year, we can:

- End the educator and counselor shortages in our schools

- Ensure all educators are paid the livable wages they deserve

- Give students, educators, and schools the resources they need

- Fix our crumbling bridges and pothole-filled roads

- Provide safe, reliable, and affordable public trains and buses statewide

- Ensure no one has to take on debt to get a college or vocational education.

A Better World Is Possible is a mostly weekly Indy feature that offers snapshots of creative undertakings, community experiments, innovative municipal projects, and excursions of the imagination that suggest possible interventions for the sundry challenges we face in our communities and as a species. The feature complements our regular column by Boone Shear, Becoming Human. Have you seen creative approaches to community problems or examples of things that other communities do to make life better for their residents that you think we should be talking about? Send your observations/suggestions to amherstindy@gmail.com. See previous posts here.