Opinion: Mia Mottley And Her Proposed Overhaul Of Global Climate Finance

Mia Mottley. Photo: Timothy Sullivan (shared on Flickr, used with permission)

Love, Justice And Climate Change

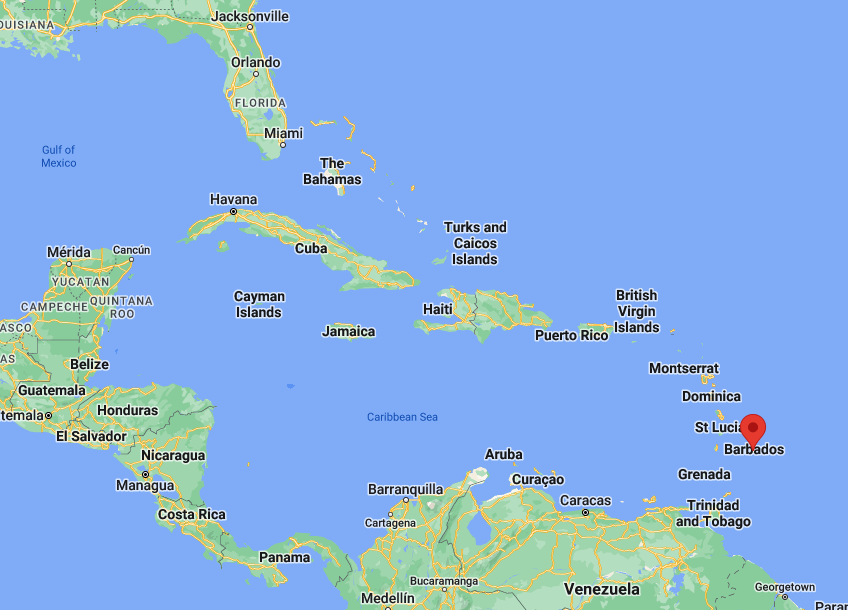

Mia Mottley was born in Barbados, a small island nation in the Caribbean. She completed college in Barbados and then went to the London School of Economics at age 18. One of her classmates at the time remembers meeting her– she was on a couch in a student apartment in London talking with everyone. He was “slightly enthralled by this person because she was like a queen, even at age 18. And people would come and pay homage. It was like a court visit.”

After graduating, Mottley went back to Barbados. She’s from a political family there and in 1994 became the youngest Barbadian ever elected to Parliament. In 2018 she became Prime Minister. She won a second term in 2022 with her party sweeping all of the seats in the legislature with 73% of the popular vote.

Mottley Speech

I first became aware of her when I saw an 8-minute video of a powerful speech she gave at the opening session of COP26 in Glasgow. It’s worth watching if you want some inspiring and engaging straight talk from a powerful leader who is a person of the global majority (Note: “People of the global majority” are also known as “people of color.” This terminology serves to remind us all that the vast majority of the world’s population is not white).

Proposal

Now Mottley has made a proposal that could lead to billions of dollars becoming available to finance climate action in frontline nations. These climate-vulnerable nations need funds to recover from climate disasters, prepare for the next disaster, and to transition away from fossil fuels.

Problems Of Frontline Nations–Solutions Needed

The problems that Barbados and other frontline nations face with regard to climate change are many. First, the global financial system has led to most of these nations carrying large amounts of debt. Financial institutions in the wealthy countries have loaned badly needed funds at high interest rates. These interest rates suck wealth out of the low and moderate income nations and enrich the wealthy ones.

Having to spend this much of their annual GDP on debt and interest payments leaves meager resources to meet the needs of their people, transition to renewable energy, or adapt to climate change. Now some might say, if they couldn’t repay the loans they shouldn’t have borrowed the money. But what are your choices when a hurricane has ravaged your country (Barbados, 2019), a drought has your population facing starvation (Somalia 2015-2023), or floods have destroyed millions of homes and wiped out most of your agricultural harvest (Pakistan 2022)? Any caring, responsible leader must get funding to address such crises.

Second, if you want to build a wind farm or solar farm in the Midwest of the U.S., you can borrow money at about 4% and it is a profitable venture. If you want to build it in Kenya or Nigeria, you will have to pay roughly 14% interest to borrow money. At that rate the project is not profitable, so it doesn’t happen. The whole world needs renewable energy projects to go forward in frontline nations all over the world in order to slow global warming, but so far has not been willing to provide financing at reasonable rates.

Third, a crisis such as the pandemic or a climate disaster can shrink a nation’s economy (whether it’s the U.S. or Barbados) and leaves it less able to make debt payments. In the U.S. student loan payments were put on hold and the IRS made $931 billion in direct payments to individuals to ease financial stress due to COVID pandemic. But frontline nations have mostly been required to continue to make debt payments even in the face of the devastation of the pandemic or a climate disaster, leaving them less able to take proactive climate action.

Bretton Woods

At the end of World War II, representatives of the 44 Allied nations met at Bretton Woods, N.H and created the World Bank and the International Monetary Fund (IMF) to help with the reconstruction of Europe and managing the global financial system. These entities did their job in rebuilding Europe then, but they are poorly designed and inadequate to address the global climate crisis.

The Bridgetown Initiative

In July, 2022 Mia Mottley gathered a team of economists, nonprofit leaders, and United Nations leaders at a meeting in Barbados to develop a proposal for overhauling the global financial system so it can address the climate crisis and provide the financing needed for climate action in frontline nations. They released the “Bridgetown Initiative“(named after the capital of Barbados) last fall, before COP27.

Many frontline nations are currently suffering from a debt crisis. They can’t take on more debt and they can’t afford to take needed climate action. To meet these problem, the Bridgetown initiative, as described by The Nation magazine, “would suspend IMF debt payments for the poorest countries, defer interest surcharges, and make $100 billion immediately available to those nations that need it.”

Adaptation Funds

A second feature of the Initiative is for the wealthy nations to increase their lending through the multilateral development banks (including the World Bank) to $1 trillion, while accepting increased risk and offering below market rates to less wealthy nations working to adapt to climate change. While this would require major changes in the IMF and World Bank, much of what is proposed could probably be done without requiring action by the U.S. Congress.

Mitigation Trust

The Initiative would also establish a climate mitigation trust with $650 billion from the IMF in what are called “special drawing rights (SDR).” These enable nations to borrow from each others reserves at very low interest rates. In the past more of these have gone to wealthier nations. The proposal is to make these SDRs primarily available to climate vulnerable countries for projects that will lead to reduced emissions or for reconstruction after a climate disaster. One expert estimates that if the IMF will put up this initial amount, it will stimulate an additional $2 trillion in private investment.

Positive Response

What is remarkable is that these proposals, spearheaded by Mia Mottley and Barbados, are getting a very positive response. The head of the IMF, John Kerry (President Biden’s climate envoy), the President of France, the head of the Rockefeller Foundation, and a great many of the climate vulnerable nations, have expressed support.

A Radical Shift

Former vice president Al Gore said at COP 27, “We need to reconvene Bretton Woods and completely revamp and reform the World Bank system.” As Tina Gerhardt wrote in a column about the Bridgetown Initiative in The Nation, “Overhauling Bretton Woods would be one of the most radical economic and political shifts of the past century. And it can’t happen soon enough.”

Russ Vernon-Jones was principal of Fort River School 1990-2008 and is currently a member of the Steering Committee of Climate Action Now-Western Massachusetts. He blogs regularly on climate justice at www.russvernonjones.org.