Citizens Advocate For Spending Priorities At Annual Budget Forum. Council Approves 4.4% Tax Hike

Photo: istock

Amherst Finance News Highlights For The Week Of November 21, 2022

Paraeducator Raises, Climate Action And Policing Reform Dominate FY24 Budget Demands

Approximately 50 members of the public attended the November 21 Fiscal Year ‘24 (FY24) Budget Forum heard by the Amherst Town Council and Finance Committee.

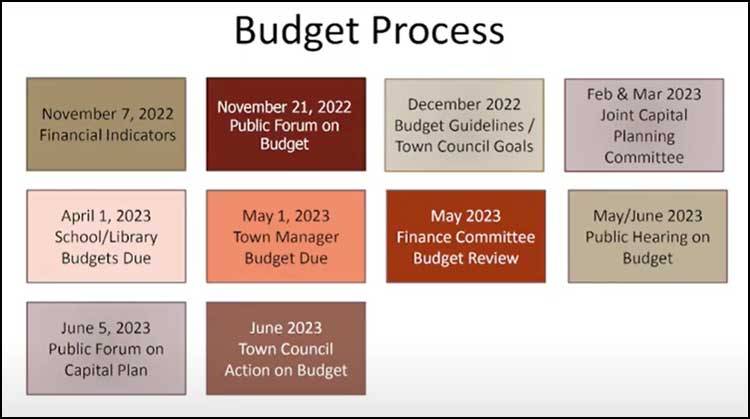

The holding of an annual budget forum is mandated by Section 5.3 of the town charter. Its purpose is for the Town Council and Town Manager to present priorities, context based on prior years’ budgets, revenue and expenditure forecasts, and other relevant information, and to solicit feedback from the public. FY24 runs from July 1, 2023 through June 30, 2024.

At the outset of the forum, Town Manager Paul Bockelman presented an introduction to the budget, stating that Amherst is in a very strong financial position, has approved a balanced budget for FY23, and continues to focus on growing reserves and reducing debt.

Finance Director Sean Mangano reported that Town Administration is proposing a 2.5% increase for operating budgets in FY24, and raising the percentage of the levy dedicated to capital expenses from 10% to 10.5%. The budget proposes a deficit of $200,000 but Mangano indicated that as yet unannounced state aid may reduce this.

Nineteen people spoke during the public comment period. Six speakers called attention to stalled negotiations between the Amherst School Committee and the Amherst-Pelham Education Association (APEA) teachers’ union.

Paraeducator Jean Fay spoke of being an Amherst resident since 1985 and public school employee since 1998, working a second job most of that time. Describing Amherst paraeducator compensation as secondary “lipstick money,” she stated that “the district is losing a lot of good young educators.” She spoke of one educator who appealed for a higher wage at a prior Town Council meeting leaving her job on the following day, while Fay’s last day is scheduled for December 23.

Massachusetts Teachers Association president and longtime Amherst resident Max Page expressed shock that the Town would claim to be in a strong financial position and actively growing reserves by reallocating surplus free cash while teachers are struggling. “There’s an ideology behind that,” he said. “We do not exist here to grow reserves and we don’t have a strong financial position to have a strong position. And much of that is paid for by underpaying your educators.” He asked the Council to “free up money now so that the School Committee is empowered to pay fair wages.”

Lydia Vernon Jones was among several members of the public who urged more funding in support of climate action — “reducing, then eliminating our carbon footprint and helping folks adapt to climate changes already here.”

“There is so much we could be doing,” she said, “much of it identified in the Climate Action Adaptation and Resilience Plan (CAARP).” She called for adding a position to the town’s Sustainability Department which now consists only of Sustainability Director Stephanie Ciccarello.

John Root of Zero Waste Amherst, who collaborated on the Amherst Solid Waste Master Plan in 2016, urged that the town adopt a recommended contracted refuse and recycling system that includes universal curbside compost pickup and a pay-as-you-throw fee structure. He said that this would require about $30,000 for a fraction of two full-time employees to assist with accounting and contract compliance.

A number of commenters raised the need to provide the town’s new Community Responder for Equity, Safety and Service (CRESS) Department with adequate funding. Martha Hanner of the Amherst League of Women Voters Racial Justice Committee asked that funding be increased to enable CRESS to provide full 7×24-hour coverage.

Both Danielle Seltzer and Kitty Axelson-Berry expressed frustration with lack of progress on completing strategic partnerships with UMass, Amherst College and Hampshire College that would provide payment for town services in lieu of taxes from which these institutions are exempt.

Rani Parker spoke to the need of allocating more capital budget funds toward improving sidewalks and regularly maintaining buildings so that they do not need to be torn down and rebuilt.

The Amherst Finance Committee will review comments made at the public forum and begin developing a FY24 Budget Guidelines document next month.

Town Council Rejects Split Tax Rate, Approves $375 Tax Hike

On November 7, the Town Council held its annual Tax Classification Public Hearing as required by state law. Principle Assessor Kimberly Mew announced the change in average single family home valuation and proposed property tax rate for FY23.

Due to market conditions, the average Amherst single family home value has risen 10.4% from $404,763 to $446,682. Mew and the Board of Assessors recommend a 2023 tax rate of $20.10 per $1000. This represents a drop from the 2022 tax rate of $21.27 per $1000. When the new tax rate is applied to the new home valuation, the average single family home’s 2023 tax bill will rise $375 to $8694, or 4.4%.

Mew recommended against initiating a split tax rate where residential property rates would decrease while commercial and industrial rates increase. She said that this would place an undue burden on businesses, noting that decreasing the average residential tax bill by $960 would result in an increase of $5594 for commercial and industrial properties.

With 6312 residential property parcels, 419 commercial parcels, 30 industrial parcels, and 177 personal property parcels, about 91% of Amherst properties are classified as residential. Mew has advised that split tax rates are generally only adopted in municipalities with at least 30% of properties being non-residential.

There was no public comment at the tax classification public hearing. The Town Council accepted Mew’s assessment recommendations unanimously.

“Mew has advised that split tax rates are generally only adopted in municipalities with at least 30% of properties being non-residential.”

The same “reason” given two decades ago, and many decades before that: it suggests a mere “custom” — let’s call it a “rhyme” — rather than a “reason”.

As my colleague Robie Hubley put it at the time:

We’re not in it for the rhyme; we’re in it for the reason!

Would the author of this article care to analyze this “reason”?