Property Tax Burden Rises 4.8% As Average Tax Bill Approaches $10,000

Photo: istock

Average Amherst Home Value Tops $500,000

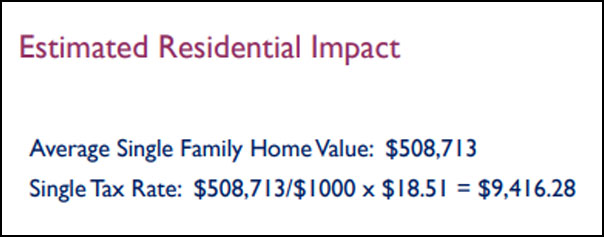

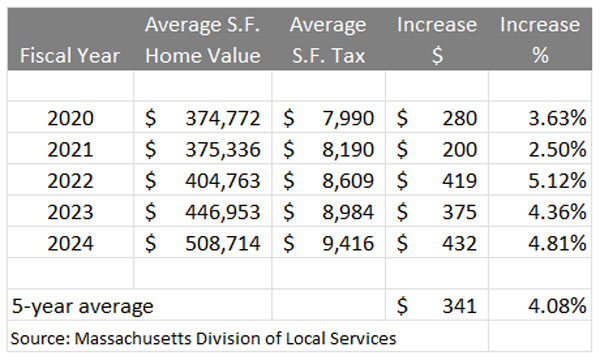

In a presentation for the Tax Classification Hearing before the Amherst Town Council on November 13, Principal Assessor Kimberly Mew announced that the average tax on a single-family home in fiscal year 2024 will be $9416, up $432 from $8984 in FY23.

The FY24 tax bill represents a tax rate of .01851 applied to the updated average Amherst home valuation of $508,713 and is the result of the town raising the tax levy by the maximum of 2 ½% allowed by state law.

The $432 jump is the largest property tax increase since a $553 jump in 2005. Even worse news for taxpayers is that it comes a year before average tax bills will incorporate an additional $451 per year debt exclusion amount for the Fort River School project for the next 30 years. The debt exclusion was adopted by voters this past May.

Last April, the Amherst Indy published a model of projected average Amherst tax bills from 2023-2054 that combined the debt exclusion increases with historic average tax increases limited by Proposition 2 ½. The model predicted that by 2054 the average Amherst tax bill will reach $29,958.

See related Opinion: Amherst Taxation Trends Portend A Dystopian Future

However the model was based on the most recent average tax increase over 5 years which for 2019-2023 came to 3.39%. The FY24 tax increase raises the 5-year average to 4.08% rendering the model already too low.

Town Manager Presents Option for Lowering Elementary School Project Impact on Tax Burden

In April the Finance Committee rejected a proposal by member/councilor Ellisha Walker to lower the tax increase for the Fort River School project by using $5 million from the Town’s capital stabilization fund toward the project.

See related Library Fundraisers Oppose Using Reserves To Lower Tax Increase

In a compromise move, the committee directed Town Manager Paul Bockelman to “develop options to reduce the financial impact of the debt exclusion for the Elementary School Building Project on residents by proposing a financing plan that identifies an additional $5M of alternative funding to be presented to the Town Council by November 30, 2023.”

On Monday night Bockelman delivered good news and bad news about his search for tax-lowering funds.

The good news was that the Massachusetts School Building Authority (MSBA) has approved raising the cap on its grant formula for school construction projects, a move that could provide Amherst with an additional $9.7 million. He credited local state legislators Jo Comerford and Mindy Domb with helping to secure the increase.

Bockelman announced no commitment on how much the new MSBA funds would lower previous tax increase estimates.

More disappointing was Bockelman’s announcement that he could not locate a town source of funds to reduce required borrowing for the school project.

“There are no magic sources of money. The only other source of funds that the council could allocate within its power would be to take $5 million from the capital stabilization funds,” he explained.

“You could take $5 million from the seven [million currently in capital stabilization] and allocate it to the school building project if you so choose. If that was the direction you want to go I could submit that [financial order] to you. I would not recommend that,” said Bockelman.

Which begs the question: where is the magic source of money for the town to borrow an additional $9.9 million for the Jones Library expansion project to cover the budget gap for the $46.1 million project?

See related Council Rushes Vote for More Borrowing for Jones Library Expansion

“Which begs the question: where is the magic source of money for the town to borrow an additional $9.9 million for the Jones Library expansion project to cover the budget gap for the $46.1 million project?”

Perhaps the answer to Jeff’s begged question lies in our beloved Amherst College — our local* “real estate hedge fund with classes attached” — has an approximately $4.6 BILLION endowment.

Just 1% of that would cover the entire cost of the Jones Library demolition/expansion option.

And a much smaller fraction of that would cover the more responsible option: rehabilitation of this historic structure as one of our three town libraries.

If the real goal of this project is to make Amherst a destination one of whose main attractions is a humanities conference center with a modern library attached, then some of that 1% could also be used build a separate facility nearby, perhaps on the very spot where the Amherst Academy once stood 2 centuries ago, just across Amity Street.

We are a community in which the life-of-the-mind plays a not-insignificant part: can we prove that’s who we are by carefully re-thinking this unfortunate metastasis…?

———

*Quoting UC Irvine professor Catherine Liu’s commentary this past March in Business Insider which begins:

“The most cutting jokes are the ones with a bit of truth behind them. While the increasingly popular quip that ‘colleges are just real-estate hedge funds with classes attached’ may inspire eye rolls, recent moves are making the joke cut deeper. ”

See also this article in The Nation from 2016:

https://www.thenation.com/article/archive/universities-are-becoming-billion-dollar-hedge-funds-with-schools-attached/

If Amherst could tax based on income it would be much more fair. But Massachusetts won’t allow that.