Finance Director Introduces New Plan To Complete Four Major Building Projects Over Next Five Years

Amherst downtown fire station. Photo: Art Keene

Projects Will Cost $ 90.8 Million And Will Require At Least One Debt Exclusion Override

Report On The Joint Meeting Of The Town Council and The Finance Committee (2/16/20)

The meeting was held via Zoom. A recording of that meeting can be viewed here.

Participating from the Town Council: Lynn Griesemer (President), Mandi Jo Hanneke, George Ryan, Alisa Brewer, Sarah Swartz, Darcy DuMont, Shalini Bahl-Milne.

Participating from the Finance Committee: Bernie Kubiak, Robert Hegner, Jane Sheffler, and Town Councilors Andy Steinberg (Chair), Cathy Schoen, Pat DeAngelis, Dorothy Pam

Staff: Town Manager Paul Bockelman, Finance Director Sean Mangano, Comptroller Sonia Aldrich. Town Financial Advisor David Eisenthal

The meeting was devoted to a presentation by Town Finance Director Sean Mangano of a new financial plan for completing four major capital projects: the Jones Library demolition/expansion/renovation, and the construction of a new elementary school, fire house, and DPW headquarters. The plan would make it possible to complete the four projects by 2026 at a maximum combined cost to the Town of $90.8 million and would require at least one debt exclusion tax override, maximum borrowing caps for each project, an increase in taxes, and withdrawing money from the Town’s reserves. The model can be viewed here.

Background

Town Manager Paul Bockelman provided background to the model, pointing out that on October 21, 2019 the Town Council made a commitment to undertake all four building projects noted above and that the model developed by Finance Director Sean Mangano addresses that commitment. Bockelman said that an assessment of the Town’s current finances yields the following takeaways:

- The Town’s infrastructure needs considerable investment now. It has been decades since the Town has built a new municipal building

- There is a mandate from the Council to build all four projects. This can be done if we adhere to following conditions: at least one debt exclusion, adherence to firm budget caps for all projects, raising property taxes, drawing on the Town’s reserves, and understanding that these expenditures will impact future operating and capital budgets

- The Town’s Finances are strong, with declining debt and strong reserves, and we continue to address our long term liabilities, such as pensions.

Mangano then presented his model , cautioning listeners that any model is only as good as its assumptions. The model has five guiding principles:

- Affordability – the Town will use dependable revenue sources, reserves, and debt exclusion to cover debt payments

- Minimize Impact on Taxpayers – use debt exclusions sparingly and use reserves to smooth out peaks in debt payments

- Complete Projects Expeditiously – projects are ready to move forward and delays could result in higher borrowing costs or sunk maintenance costs. Consider long-term needs of the Town, including other building replacements

- Maintain Focus on Asset Maintenance — continue funding capital at a required level to prevent spikes in capital costs

- Stay Flexible – be prepared to respond to changing market conditions and unanticipated expenses

Working Prerequisites:

- Taxpayer approval of at least one debt exclusion, and if only one, it must be for the school

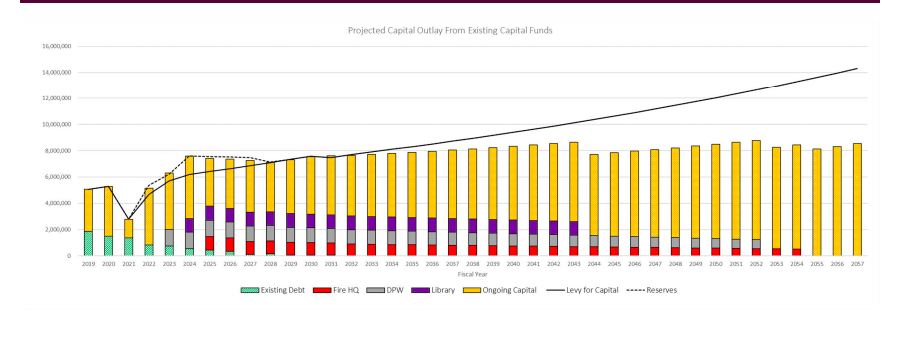

- Funding of capital at 10.5% of the tax levy for the next decade

- Establishing funding caps for each project

- Using $4.6 million of the Town’s reserves

- Understanding the impact on future operating and capital budgets

- Understanding the impact on the debt load of the Town

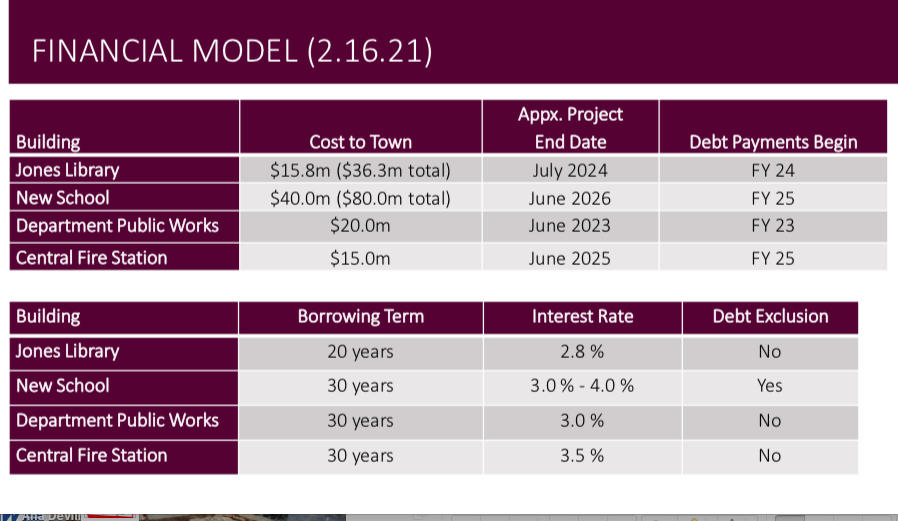

With those considerations in mind, the schedule and costs for the four building projects along with borrowing caps are represented below.

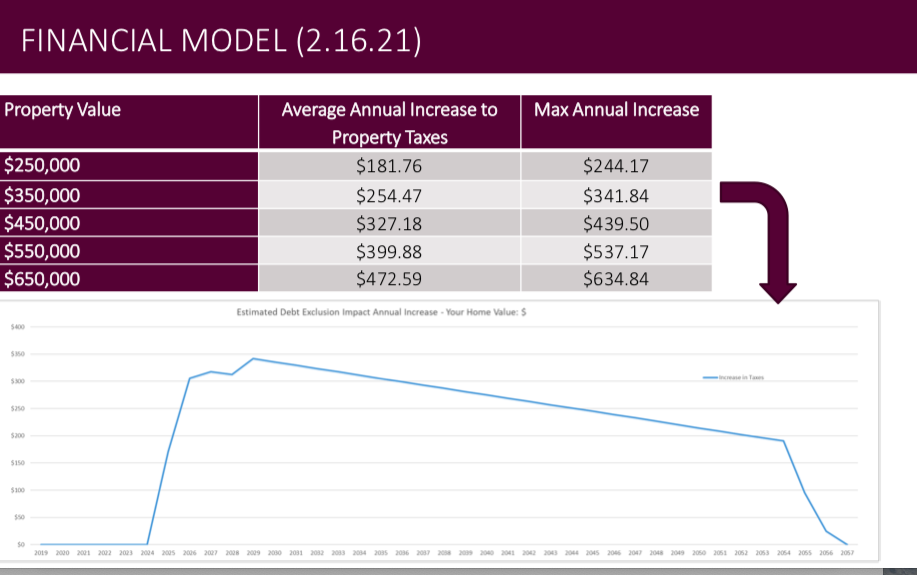

And the impact of a school debt exclusion for the school on property taxes is presented below.

Mangano also presented a modeling tool that allows the user to see the impacts of changing borrowing terms for each of the four building projects. This tool is a modification of an earlier version of a spreadsheet tool initially developed by then Town Finance Director Sandy Pooler in 2015 and subsequently revised by Mangano and introduced to the Council in February 2019. At some point, the tool will be accessible on line to the general public.

Councilors’ Questions

Councilors raised many questions following the presentation and not all could be answered in the time remaining.

Cathy Schoen (District 1) asked how much flexibility we have on using reserves? In the tough years, could we draw down more? Also, do we have a site for the DPW (the chart in the model presentation suggests that there will be a site discussion on February 26)? What happens if the library can’t meet its fundraising pledge? What do we do if the library costs comes in over its $35.8 million estimate? If we are awarded the MBLC library grant and accept it, has the fact that we have to put up the money to be later reimbursed been factored in? If we’re going to rigidly adhere to the cap, what do we have to do to move forward?

Mangano responded that with the library, we’re looking at both options: use grant monies upfront or use town money first. Apparently, if the grant is awarded this summer, the Town could use that money and wouldn’t have to make any payments on the library for a couple of years.

Bockelman then noted that he has promised a memo on the DPW/Fire Station siting by the end of February.

Dorothy Pam (District 3) asked Mangano how much new revenue he counted on when he ran these numbers. She also asked about community broadband and funding for sidewalks.

Mangano responded that the primary new revenue estimated is from new property tax levies. He estimated an increase of 2.5 percent annually. He noted that broadband is not part of this plan and that sidewalks would come out of the ongoing capital needs budget.

Bob Hegner pointed out the cost caps on each project and asked whether, given that there are always cost overruns, are cost overruns being calculated in the model?

Bockelman emphasized that we can’t do everything that everyone wants, and that everyone is going to have to work within the budget. Contingencies for cost overruns will be built in, he said.

Lynn Griesemer (District 2) said that a 10 percent cost overrun contingency is usually built in for projects like these.

Asked about net zero energy for the projects, Mangano noted, “We’re going to have to renegotiate with the designers of these projects now that we’re moving forward” to see what is possible.

Shalini Bahl-Milne (District 5) asked, “What can we tell our District 5 constituents about Crocker Farm school?”

Mangano responded that there is a connection between this model and the capital improvement program, which will be discussed at the JCPC meeting on February 18. Some Crocker Farm school improvements have been Identified by the capital improvement program but have not yet been slotted with a date.

Pat DeAngelis (District 2) asked about the cost of purchasing property for the DPW/fire station projects and whether land acquisition is included in the DPW budget cap? She was told that it is. She also asked whether, if the sixth grade moves to the middle school, would it still be part of the elementary school budget? Mangano answered “most likely, yes” and that to do otherwise would require rewriting the regional agreement.

Schoen noted that the numbers cited for the DPW and fire station are a lot lower than previously discussed. She asked, whether there is any basis for thinking that those are real numbers and whether “they can get us most of what we want”?

Mangano responded that the numbers came from looking at projects in other towns and then considering what the model for building all four projects can support. “We’ll know a lot more once we go back to the designers,” he said.

Public Comment

Richard Morse said that there is a lot of fear out there about the Town’s ability to undertake all of these projects. He asked Councilors to please make an effort to understand finances, the way Sean Mangano does, before they undertake hugely consequential votes. “Please,” he said, “ask all of the questions that you need to ask to get a command on this plan… There is no such thing as a stupid question when it comes to this plan.”

Toni Cunningham offered praise for assigning budget caps from the outset, and then asked to return to Schoen’s question about what would happen if the costs exceed the caps?

No contingencies have been added yet to the library project even though the numbers we have are based on construction beginning in 2019, she said, so what happens if the cost goes above the $15.8 million cap because of construction cost increases and what happens if there is failed fundraising? Also, she asked, what about the CPA (Community Preservation Act) funds? Who will get credit for that, the Trustees or the Town? Cunningham also noted that water bills are expected to go up over $400 average with the reconstruction of the Centennial water treatment plant, which most residents do not know about. This is more than many people will experience with the override for the school. She concluded with a request for caution so as not to resurrect the divisive school building project. “Let’s look forward and unite the town,” she said.

Griesemer responded that the Town Council has not decided whether or not to accept the CPA recommendation for library funding and if they do, which side of the ledger that money will be credited to.

The next meeting of the Finance Committee will be March 2.

I note with deep regret that the proposal to put the most popular, desired project, the new elementary school funding, be subject to

approval of the debt exclusion over-ride. The more contentious, least popular projects will be funded under the tax levy. Local politics raising its ugly head!! I hope there will be a loud public outcry for this attempt to railroad this flawed policy through the Council.

To me, the most striking takeaway from Tuesday’s big reveal was what it would do to operating budgets for the next few years. An override for the school makes sense to me in that it is the most expensive project and likely the most popular.

However, 1-1.5% increases to operating budgets will mean job cuts.

It may mean fewer teachers in the schools, leading to bigger class sizes or the loss of electives.

It will mean fewer firefighter paramedics in a department that is already reportedly understaffed.

It will mean fewer IT professionals to manage the growing volume of virtual meetings and communicating information to the public.

It will mean fewer librarians and other library staff (how’s that going to work in a larger Jones library?). How will it affect the branch libraries??

It will mean fewer public works staff to plow roads and maintain water and sewer systems.

Fewer custodians and maintenance workers to clean and repair town buildings, something that will be even more vital when we return to those buildings and have to live with Covid, and no doubt, future pandemics.

We already see what a 1% budget increase means to the regional schools this year: 16 fewer positions.

If we, as a town, move forward with all of these four big projects as proposed on Tuesday, even if none go over their budgeted cap (which I expect is extremely unlikely, especially in the case of the library expansion), the resulting cuts to operating budgets will devastate town departments.

Let’s be realistic and forward-thinking, and make rational decisions about what we can truly afford, without sacrificing so much.

In March of 2016, Weston & Sampson, a Boston “planning, permitting, design, construction, operation and maintenance firm” presented their summary report on the programming, planning and site selection costs for a new facility to house the Amherst DPW.

Estimates for four options were: Fort River school site = $37 million; Old Farm Road = $38.3 million; Ball Lane = $37.3 million; and renovation of the existing site = $36.7 million. Now, five years later, the Finance Committee reckons the Town will only have to spend

$20 million since that is the cap they have set.

Am I missing something here? If not, I’m off to buy a fully-loaded 2021 luxury Prius. They cost c. $30,000 but, fortunately, I have set a $18,000 cap on the amount I’m willing to spend, so it shouldn’t be any problem.

Delaying any of these projects is just pushing costs down the line. Instead of duking it out as residents, the pressure needs to be on the town, finance director, and finance committee to make sure we are leveraging all creative funding options. For example, can we leverage green bonds or additional climate-resilient infrastructure funding to make buildings that save us in operating costs and avoid funding stranded assets? Funding is going to be coming down the line for this, are we ready and willing to take a leap of faith and think outside the box so we can access it? I also am pretty shocked to see the above commenters note that the school would be the easiest to get through an override -they must not have the same memory that I do of how contentious and ugly that process was a few years ago and somehow, even though the override passed, it still didn’t result in a new school!

While any override is difficult to pass, it will be a whole lot easier when it’s for a plan that half the town don’t hate.

Toni, glad to hear you assume half of the town won’t hate this new plan then. I will hold you to that.